Ultimate Overview to Understanding Business Volunteer Agreements and Just How They Benefit Organizations

Company Voluntary Arrangements (CVAs) have come to be a critical tool for businesses wanting to navigate economic challenges and reorganize their operations. As business landscape proceeds to advance, recognizing the intricacies of CVAs and how they can favorably impact companies is crucial for educated decision-making. what is a cva in business. From giving a lifeline to having a hard time organizations to cultivating a course towards sustainable development, the advantages of CVAs are multifaceted and tailored to address a range of company needs. In this overview, we will check out the nuances of CVAs, clarifying their advantages and the process of execution, while also delving into essential considerations that can make a significant difference in a company's financial health and wellness and future potential customers.

Recognizing Business Volunteer Arrangements

In the world of corporate governance, a fundamental concept that plays an essential role in shaping the relationship between stakeholders and firms is the elaborate system of Company Voluntary Arrangements. These agreements are volunteer dedications made by firms to follow specific criteria, methods, or objectives beyond what is legally called for. By participating in Company Voluntary Contracts, companies demonstrate their commitment to social duty, sustainability, and moral company practices.

Benefits of Corporate Volunteer Agreements

Moving from an exploration of Business Voluntary Arrangements' significance, we now turn our attention to the concrete advantages these contracts offer to firms and their stakeholders. One of the key benefits of Company Voluntary Arrangements is the possibility for business to restructure their debts in an extra manageable method. This can assist relieve monetary worries and stop possible bankruptcy, enabling the company to continue operating and potentially grow. Furthermore, these arrangements provide a structured structure for arrangements with lenders, promoting open communication and cooperation to reach equally advantageous solutions.

Moreover, Business Volunteer Arrangements can improve the company's reputation and connections with stakeholders by demonstrating a commitment to dealing with monetary obstacles responsibly. Generally, Business Volunteer Arrangements offer as a critical tool for business to navigate economic obstacles while protecting their procedures and connections.

Process of Carrying Out CVAs

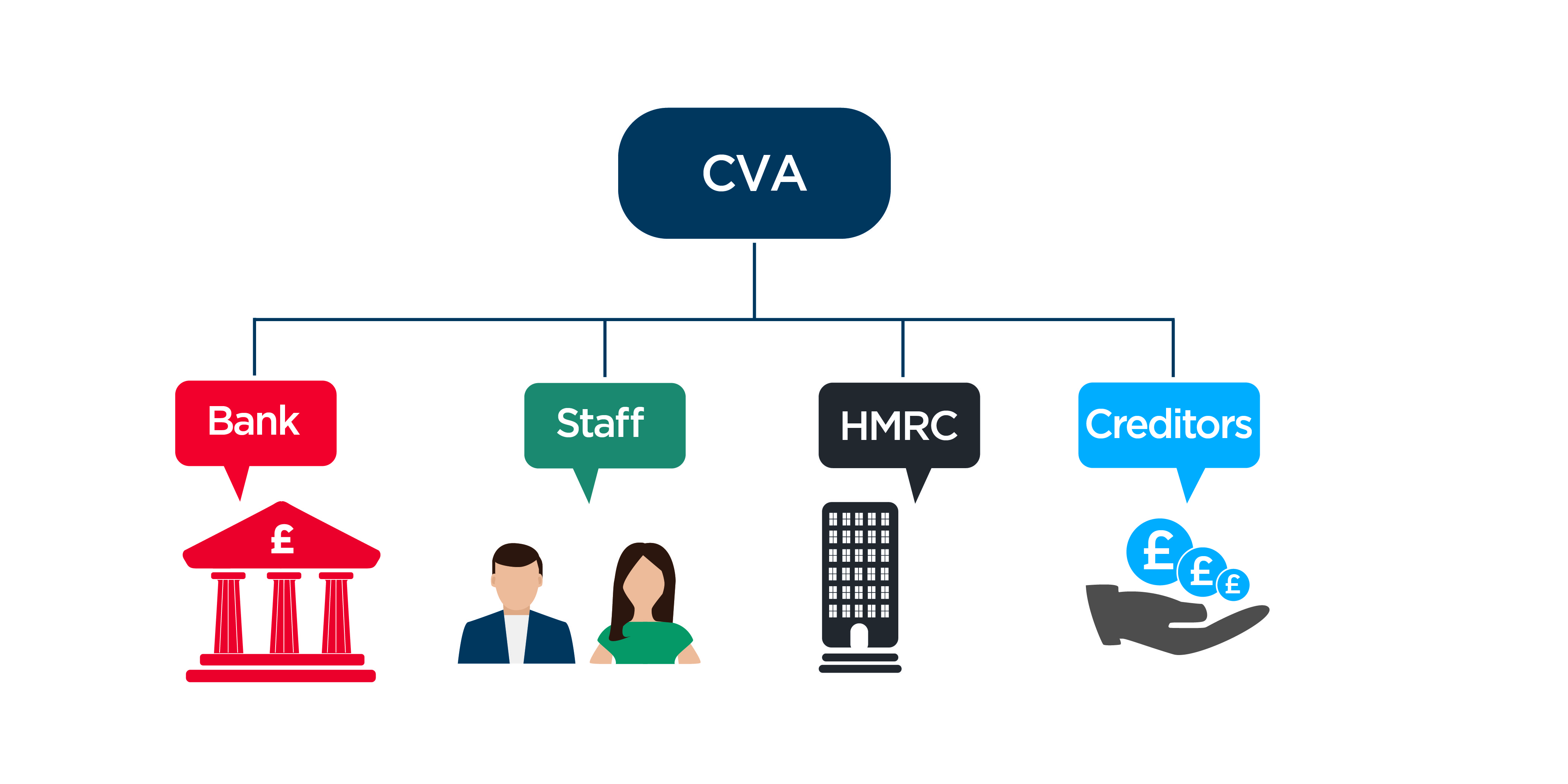

Comprehending the process of carrying out Business Volunteer Arrangements is necessary for firms seeking to browse economic obstacles successfully and sustainably. The primary step in executing a CVA includes assigning a certified insolvency practitioner who will work carefully with the business to analyze its economic situation and feasibility. This preliminary evaluation is essential in establishing whether a CVA is the most appropriate service for the company's financial difficulties. When the decision to wage a CVA is made, a proposal outlining how the business plans to repay its financial institutions is composed. This proposition must be authorized by the business's financial institutions, that will elect on its approval. If the proposal is approved, the CVA is carried out, and the business must comply with the agreed-upon settlement plan. Throughout the execution procedure, normal interaction with creditors and diligent economic administration are key to the effective execution of the CVA and the company's eventual financial healing.

Secret Considerations for Organizations

When examining Company Voluntary Agreements, organizations have to very carefully take into consideration key elements to make sure effective financial restructuring. Additionally, companies must extensively review their existing financial obligation framework and examine why not look here the influence of the CVA on numerous stakeholders, consisting of staff members, financial institutions, and suppliers.

One more important consideration is the degree of openness and communication throughout the CVA process. Open up and sincere communication with all stakeholders is important for building trust and making certain a smooth application of the contract. Businesses need to likewise consider looking for expert advice from lawful professionals or financial experts to navigate the intricacies of the CVA process properly.

Moreover, businesses require to evaluate the lasting ramifications of the CVA on their reputation and future funding opportunities. While a CVA can supply immediate alleviation, it is vital to review how it might impact partnerships with creditors and capitalists over time. By very carefully considering these crucial factors, companies can make enlightened decisions relating to Company Voluntary Contracts and establish themselves up for a successful monetary turn-around.

Success Stories of CVAs in Action

A number of services have actually successfully carried out Company Volunteer Agreements, showcasing the efficiency of this economic restructuring device in rejuvenating their procedures. One significant success tale is that of Business X, a having a hard time retail chain encountering bankruptcy because of placing debts and decreasing sales. By becoming part of a CVA, Company X was able to renegotiate lease contracts with proprietors, reduce overhead costs, and restructure its debt responsibilities. Consequently, the firm had the ability to support its financial position, improve cash flow, and avoid insolvency.

In another instance, Firm Y, a production firm burdened with tradition pension plan responsibilities, made use of a CVA to rearrange its pension commitments and enhance its procedures. With the CVA procedure, Firm Y accomplished considerable cost savings, improved its competitiveness, and secured long-term sustainability.

These success tales highlight how Company Volunteer Agreements can give having a hard time businesses with a viable path towards financial recovery and functional turnaround - cva meaning business. By proactively attending to financial obstacles and restructuring commitments, companies can arise more powerful, a lot more active, and better positioned for future development

Verdict

In final thought, Business Volunteer Contracts offer companies a structured method to solving monetary problems and reorganizing financial obligations. By carrying out CVAs, business can prevent insolvency, secure their possessions, and keep partnerships with creditors.

In the world of business administration, an essential principle that plays a critical duty in forming click the relationship in between stakeholders and firms is the elaborate device of Corporate Voluntary Arrangements. By getting in right into Corporate Volunteer Agreements, companies demonstrate their commitment to social responsibility, sustainability, and honest service techniques.

Relocating from an expedition of Company Voluntary Agreements' importance, we now turn our focus to the concrete advantages these arrangements use to companies and their stakeholders.Moreover, Corporate Volunteer Contracts can enhance you could try this out the firm's track record and relationships with stakeholders by showing a commitment to dealing with economic difficulties sensibly.Comprehending the procedure of carrying out Corporate Voluntary Arrangements is vital for companies looking for to browse monetary obstacles efficiently and sustainably.

Comments on “Comprehending Corporate Voluntary Agreement: CVA Meaning in Business”